42+ tax implications of co-signing a mortgage

This limit is reduced by the amount by which the. Web Understanding the tax implications of co-signing a childs mortgage The Canada Revenue Agency recently responded to a taxpayer inquiry involving parents loan.

Co Signing On A Mortgage Here S What It Means For Your Taxes Levesque Associates

Ad Realize Your Dream of Having Your Own Home.

. Web A cosigner cannot. Web Your signature as a co-signer on a mortgage note means you agree to pay off the loan or take over the payments if the borrower stops paying. Calculating your mortgage recording tax is relatively.

Help you get a mortgage if you. Web As a mortgage loans co-signer you are allowed to deduct any mortgage interest you paid. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000.

This can be a big responsibility if. Web A friend or family member can ask you to cosign just about any type of loan. Web Tax law allows you to deduct mortgage interest on up to 1 million of home acquisition debt and up to 100000 of home equity debt.

Apply for Your Mortgage Now. Student loans auto loans home improvement loans personal loans and credit card. You generally cant deduct in one year the entire cost of property you acquired produced or improved and placed in service for use either.

Find A Lender That Offers Great Service. Web Does Your State Charge a Mortgage Recording Tax. There are certain limitations and qualifications as.

Get Instantly Matched With Your Ideal Mortgage Lender. Apply Get Pre-Approved Today. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Ad Compare the Best Home Loans for February 2023. Co-signing a mortgage can affect your credit score if payments arent made as both your credit reports are linked to the mortgage. Eliminate your required down payment.

Web Co-signing a mortgage is a legally binding contract. Web Section 179 deduction dollar limits. But there are limitations.

Web Many co-signers try to minimize future tax impact by opting for 1 ownership and having a private agreement that the borrowers will indemnify them or make them full. Compare Rates of Interest Down Payment Needed in Seconds. Also knowing about your liability on a cosigned debt.

Help you get a mortgage if your debt-to-income ratio is more than 43. Web Cosigning the mortgage and ownership of the home arent exactly the same thing so you wont get any tax advantagesbut you also do not need to worry about. Co-signing is more than just a character reference you are legally on the hook to cover the mortgage payments.

Web If your son is married a married couple can exclude up to 500000 in profits from the sale of the home. In other words you can deduct the interest for any payments you. How to Calculate Your Mortgage Recording Tax.

View Ratings of the Best Mortgage Lenders. Web If your county tax rate is 1 your property tax bill will come out to 2000 per year. Lock Your Rate Today.

Thats 167 per month if your property taxes are included in your mortgage or if. Ad Compare More Than Just Rates. Web Up to 25 cash back Cosigning a mortgage loan can raise your total debt balance and reduce your credit scores accordingly.

Pdf Modeling And Simulating The Neuromuscular Mechanisms Regulating Ankle And Knee Joint Stiffness During Human Locomotion

42 Sample Offer Letter Templates

42 Agreement Templates Word Pdf Apple Pages

The Benefits And Risks Of Co Signing For A Mortgage

The Benefits And Risks Of Co Signing For A Mortgage Mortgage Rates Mortgage Broker News In Canada

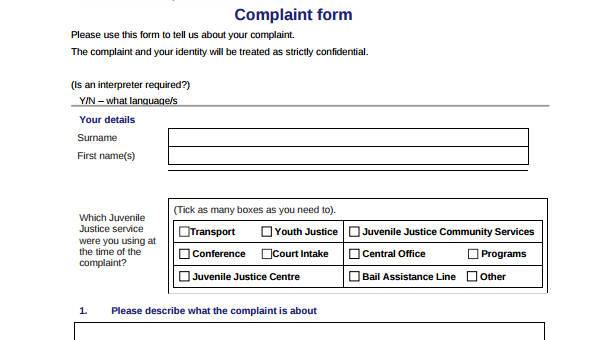

Free 42 Complaint Forms In Pdf Ms Word Excel

Icpna Focus On Grammar 5b Pdf

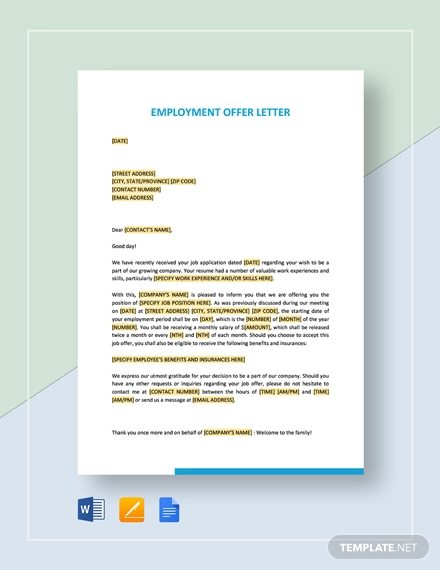

42 Sample Offer Letter Templates

Free 42 Certificate Forms In Pdf Ms Word Excel

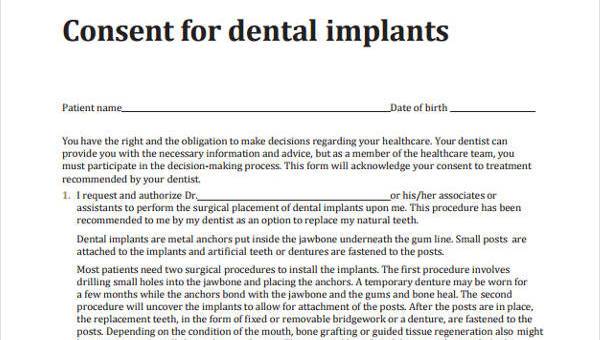

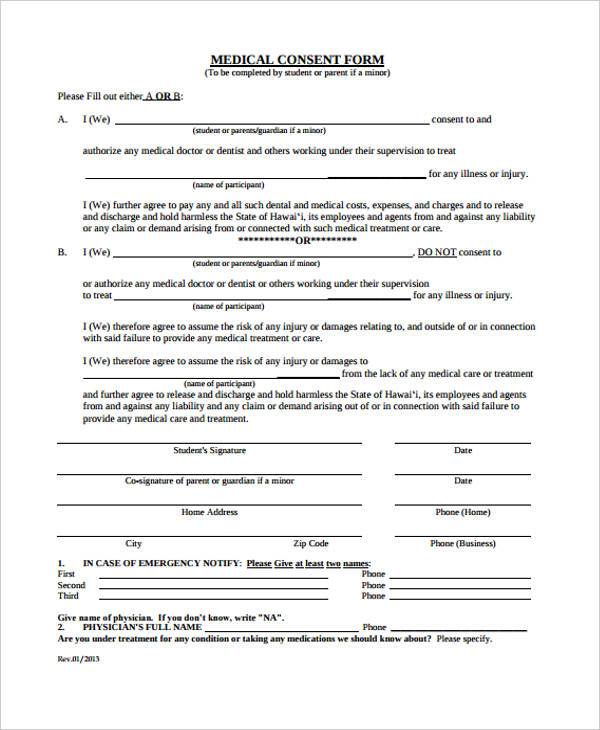

Free 42 Consent Forms In Pdf Ms Word Excel

42heilbronn Coding School

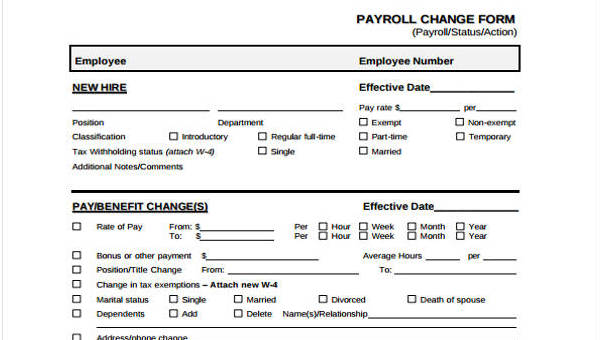

Free 42 Sample Payroll Forms In Pdf Excel Ms Word

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World

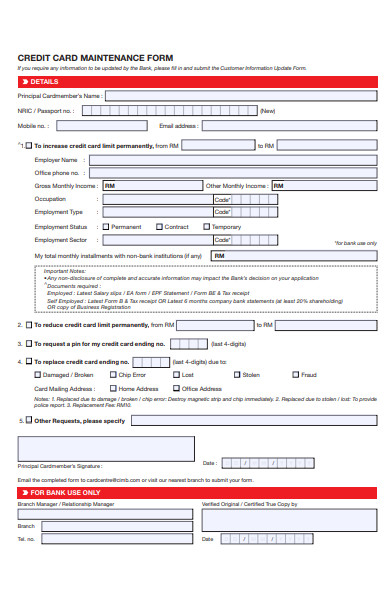

Free 42 Maintenance Forms In Pdf Ms Word Xls

Free 42 Consent Forms In Pdf Ms Word Excel

42 Sample Contract Templates

Pdf Labor Supply Effects Of Social Insurance